early half of all Americans will file their taxes online this year, and that number is only going up. Many people are filing online for the first time, and if this is you, you’re not alone. Between 2019 and 2020, e-filing rates increased by 5.9%. And it only got worthier from there. Tax softwares have been exploding in popularity. From the ease of filing from your hovel to the cost-effective self-ruling plans misogynist to most people, it’s a no-brainer to file online. There’s still one big problem with tax software, though.

How Do You Find The Weightier Tax Software?

Choosing a tax software is an important visualization since it can make the difference between a fast, easy return and dealing with a time-consuming IRS audit.

That’s why we’re doing a deep swoop on the weightier options to help you get your taxes washed-up on your terms.

How To Segregate The Weightier Tax Software For You?

:max_bytes(150000):strip_icc()/OnlineTax_Khaosai-Wongnatthakan-48c46a6998c84be29426e4bf2d58afda.jpg)

There are tax prep softwares everywhere this time of year. They range from well-known to totally obscure. When you swoop lanugo internet rabbit holes to find the weightier tax software, you end up on finance sites that may or may not plane have anything to do with taxes. The increasingly specific you are on the venery for the perfect software, the harder it gets to find one that checks all the boxes. Complicated returns that include things like self-employed income or multiple state returns make it plane harder to find help. Upgrades, packages, features… Just making a nomination can be overwhelming. Worst of all, most people aren’t all that familiar with filing taxes. After all, you only do it once a year. So how do you know what to squint for in the weightier tax software?

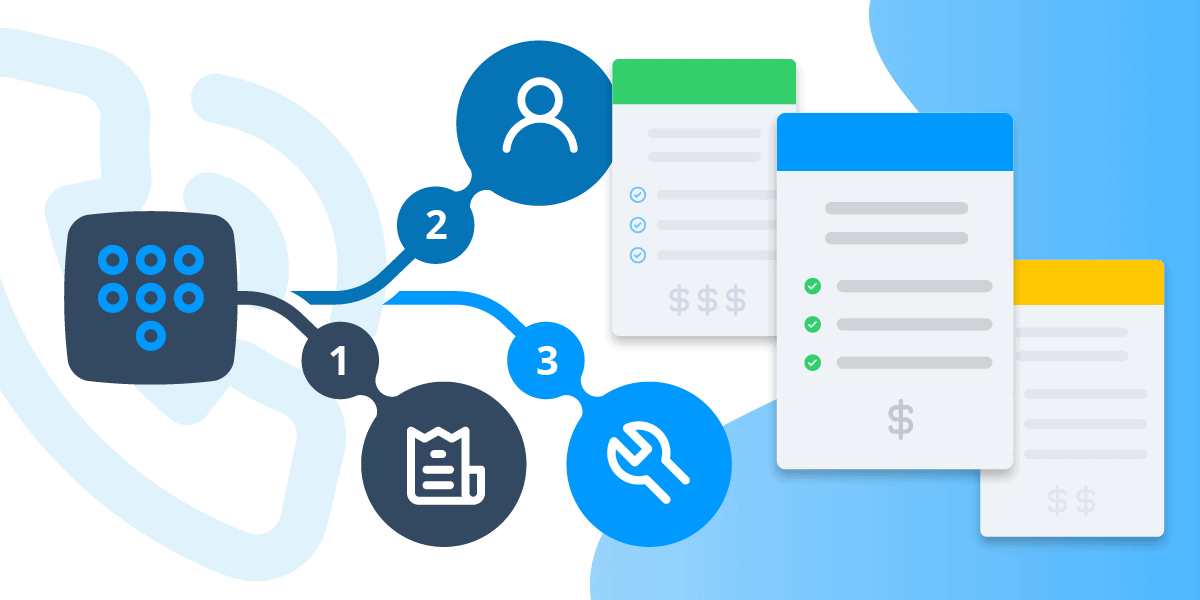

Well, there are three main considerations when choosing a tax software that works for you.

1. What kind of help will I get?

2. How many forms can I file?

3. What will it unquestionably cost?

What Kind Of Help Will I Get?

This is an important question. Since many people aren’t familiar with the process or laws involved in filing taxes, the value of help you get can make or unravel your experience.

Some people once have a vital understanding or are well-appointed doing lots of research when necessary.

These people will get withal just fine using software that has little help and no in-person assistance.

Meanwhile, people new to filing taxes or people who want to save time on the process have variegated needs.

The weightier tax software for these folks is one that will offer them a large library to help with questions or a plan with one-to-one assistance from an expert.

How Many Forms Can I File?

This question is critical for people with ramified tax situations. However, this category is still worth looking at if you have a simple return. Most people will file at least two forms. One for your federal return and one for your state return. If you have any investments, own property, or made large donations to charity, you’ll have more. And if you have a “side hustle” or work multiple jobs, that ways increasingly forms. Most “free” tax softwares are only self-ruling for the first form, and tuition fees for your state return, unorganized income, and some deductions. When trying to segregate the weightier tax software, make sure you aren’t going to miss a key form.

How Much Will It Really Cost?

The limit on how many forms you can file leads perfectly into the third thing to squint for. How much can you unquestionably expect to spend? Most tax software advertises itself as stuff “free to file”, but that’s usually not quite true. And that’s ok!

Even when upgrading to a plan, you can still save compared to filing with an in-person tax preparer. However, if you want to find the very weightier tax software for you, you’ll need to know what your specific situation will cost.

This will help you shop around, so you don’t end up paying uneaten for a plan you don’t need.

Best Tax Software Plans For Individuals In 2024

Let’s start with our 10 weightier tax software picks for individuals.

Filing as an individual can be as simple or ramified as you’d like.

Tax softwares will all walk you through the deductions you can get, but you don’t have to requirement all of them.

A word of warning, though – skipping tax deductions may save you time, but it ways a smaller return.

There are moreover some deductions you have to prepare in whop for.

For example, you can requirement a deduction for your momentum to and from work, but only if you know how many miles the momentum has put on your car.

As you wrap up this tax season, consider asking your tax expert well-nigh prepping for other qualifying deductions.

The weightier tax software will alimony things simple for you, so it’s worth doing a bit of research to make sure you don’t miss anything obvious.

For example, some home repairs are tax-deductible, but not all tax software will ask well-nigh them.

A little research superiority of time could make a big difference in your tax return in 2024.

In this blog, you’ll see the help, form limit, and financing of variegated tax software, but these should only let you know which software to squint into further.

Once you have a few in mind, shop around!

Make sure you’re working with the weightier tax software for your situation.

1. H&R Block – Self-ruling Edition

Tax giant H&R Block has been a household name in taxes for increasingly than 50 years, so it’s no surprise they’re our very first pick for weightier tax software.

With their stereotype tax pro having virtually a decade of experience, they’re perfect for people looking for help and trying to transition to doing their taxes online.

Best For: People who are new to filing taxes online and want lots of guidance.

| Free Version | |

| Help Available | No in-person, large library |

| Form Limit | 1 Federal, multiple state |

| Final Cost | $0 |

2. TurboTax – Self-ruling Edition

A tropical second to H&R Block, TurboTax really made a name for themselves as the best tax software for people new to filing taxes.

They full-length dozens of helpful blogs, a supportive online polity of increasingly than 3 million members, and on-demand help with their paid plans.

Best For: Anyone who is familiar with the internet, but could use some tax guidance now and again.

| Free Version | |

| Help Available | No in-person, large library online community |

| Form Limit | 1 Federal, 1 state |

| Final Cost | $0 |

3. Cash App Taxes

Formerly Credit Karma Tax, this service is TurboTax’s younger, free-er cousin.

With Cash App Taxes, you can file totally self-ruling – they won’t plane upsell you, since they don’t have any paid plans.

People who are stressed by upsells and want to file on the go will find that Cash App Taxes is the weightier tax software for taking that uneasiness away.

Best For: People who want to file from their phone and are confident flying solo.

| Help Available | No in-person, no library |

| Form Limit | None, plane if you’re filing for several deductions |

| Final Cost | $0 |

4. Self-ruling Tax USA

Most blogs that review the weightier tax software focus on the few big companies out there.

While the expert support with something like TurboTax or H&R Block is great, the forfeit for that support can be pricey.

That’s why we included Free Tax USA on our list.

This software allows you to file your federal returns for free, no matter what your tax situation is.

Their self-ruling edition covers a variety of tax situations, and their comprehensive paid version is one of the weightier on this list.

Best For: People looking to spend as little as possible while still getting wangle to live help.

| Free Edition | Deluxe Edition | |

| Help Available | No in-person, no library | Live tax support |

| Form Limit | None, plane if you’re filing for several deductions. | None |

| Final Cost | $0 federal, $14.99 for state | $6.99 to upgrade $14.99 for state filing = $21.98 |

5. ezTaxReturn

As they say on their website, “Bigger isn’t largest when it comes to your taxes”.

We agree, which is why ezTaxReturn found a place on our list of weightier tax software.

As a small, tax-only company, they’re defended to a straightforward process.

That ways they requite up-front pricing and won’t try to upsell you.

While their self-ruling version is pretty limited, any paid edition offers “no-wait-on-hold” phone support.

Best For: People who want to get their taxes taken superintendency of as quickly as possible with no upsells.

| Free Edition | Deluxe Edition | |

| Help Available | None unless you moreover file a state return. | Phone support staff will call you at a user-friendly time for you, questions can moreover be submitted in writing. |

| Form Limit | 1 federal | None |

| Final Cost | $0 for federal, $19.95 for state | $39.95 for federal and state |

6. 1040.com

We’ll say this upfront: 1040.com isn’t for you if you’re looking for something free, and it’s worth it.

As you’ve once seen, most “free” tax software isn’t really self-ruling and the final forfeit can reservation you totally off-guard.

1040.com is one of the weightier tax software options considering they fix that.

They don’t offer a self-ruling return at all.

Instead, everyone pays the same unappetizing rate to file both federal and state returns.

This ways that no matter how simple or ramified your return is, you’ll pay just $25 total.

Talk well-nigh a steal! Weightier of all, 1040.com partners with several charities, so you’ll be giving when just by filing taxes.

Best For: People who want to requite when while filing a no-frills tax return.

| Help Available | No live help, but an wide-stretching library. |

| Form Limit | None |

| Final Cost | $25 |

7. Jackson Hewitt

Best known for their pop-ups in grocery stores and malls, Jackson Hewitt has been helping Americans file taxes for nearly half a century.

They’ve kept up with the changes in filing taxes and now offer two online options.

With Jackson Hewitt, you can file vacated or with a tax expert.

When you file alone, you still have wangle to live consumer support and their 100% satisfaction guarantee.

They’ll refund anyone who isn’t completely satisfied with their experience.

Filing with a tax expert online is a hands-off process.

You requite them the info they need and they take superintendency of the rest.

No matter how complicated your return is, you’ll pay one unappetizing fee.

The simplicity of Jackson Hewitt makes them a top contender for weightier tax software.

Best For: People who want a lot of guidance without complicated pricing guides.

| File Alone | File With A Tax Expert | |

| Help Available | None | Live support allows you to take a hands-off approach. |

| Form Limit | None | None |

| Final Cost | $25 to file both federal and state | $99 |

8. TaxHawk

One of the fastest-growing tax softwares on the market, Tax Hawk makes filing your taxes a smooth, streamlined process with a thoughtful diamond and spanking-new service.

Their customers requite a 4.8-star overall rating, and they squire unhappy customers wideness the board.

No matter what your situation is, TaxHawk wants to help.

They have three options for their users to segregate from, so you can pick the weightier tax software help for your situation.

Best For: Bargain-hunters who like lots of options.

| Free Edition | Deluxe Edition | Pro Support | |

| Help Available | None | Live chat | Phone and screen-share support |

| Form Limit | 1 Federal | None | None |

| Final Cost | $0 for federal, $14.99 | $6.99 | $24.99 |

9. IRS Self-ruling File

That’s right, you can file your taxes directly with the IRS.

The IRS has partnered with the weightier tax software’s on the market to provide self-ruling filing to qualifying taxpayers.

This includes the forms you need to file, live help, and refund tracking.

The site can be difficult to navigate, but if you qualify you can file your federal (and some state) returns completely free.

Best For: People who don’t mind putting in some time to file for free.

| Help Available | Varies by eligibility |

| Form Limit | None |

| Final Cost | $0 for federal, $0 for some states |

10. Quicken

Last on our list of weightier tax software is Quicken.

Quicken does increasingly than just help you prepare for taxes.

It’s an all-in-one financial software that can help you with budgeting, investing, saving, and plane paying bills.

At the end of the year, Quicken gives you a print-out with your financial information from the whole year.

While you can’t directly file with Quicken, it makes filing on your own much easier.

More importantly, it helps you take when tenancy of your finances and grow your wealth.

Best For: People who know that taxes are just a piece of the personal-finance puzzle.

| Deluxe Edition | Premier Edition | |

| Help Available | Large online polity and blog library | Large online polity and blog library |

| Form Limit | N/A | N/A |

| Final Cost | $31.19/year | $46.79/year |

Best Tax Software For Freelancers And Small Businesses In 2024

Now we’ll be looking at the weightier tax software for freelancers and small businesses.

These situations can make taxes increasingly complex, so it’s important to have a tax software you can rely on.

When freelancing or running a small business, there are other things to take into consideration when doing your taxes.

Whether you’re filing as a freelancer, small business, or individual, the hardest part of doing taxes is the prep.

When you freelance or run a business, there are increasingly steps to preparing for your taxes.

The weightier tax software will requite you year-round wangle to help you stay on top of the prep.

When you have that uneaten bookkeeping help directly from your tax filing system, you can track your business’s expenses and income.

Tracking expenses and income can do two huge things when it comes time to file taxes.

First, it can help you get a worthier return.

Secondly, good record-keeping can prevent you from stuff audited and can make the process run increasingly smoothly if you do.

The final thing to take into consideration when searching for the weightier tax software for your small merchantry is quarterly payments.

Some freelancers and small businesses prefer to make quarterly tax payments instead of paying all at once at the end of the year.

Some tax softwares will send reminders or process the quarterly payments for you.

If this is something you prefer, trammels with your tax software choices to see how they handle it.

And again, don’t be wrung to shop around!

Your merchantry is important to you, and you deserve to finger confident and included in the process of filing taxes for it.

1. TaxSlayer

When it comes to ramified tax situations, you can finger taken wholesomeness of.

Many companies present you with two options: pay a little and fly totally solo, or pay a lot and get the help you need.

TaxSlayer is different. Their self-employed package is one of the weightier tax software options on the market considering it has everything you need for one price.

All the forms, wangle to a tax expert, and plane quarterly tax reminders.

They’ll guide you through the process from start to finish.

The normal stress of filing taxes as a merchantry owner or freelancer just melts away!

Best For: People looking for an all-in-one solution at a unappetizing price.

| Self-employed | |

| Help Available | Live chat, phone, and email support |

| Form Limit | None |

| Final Cost | $54.95 federal $39.95 state |

2. TaxAct

Choosing a tax software is something you do every year.

With all the options on the market, it’s no surprise most people don’t pick the weightier tax software for them on the first try.

That’s why TaxAct lets you upload your forms from last year, plane if you used flipside software.

Once you upload the basics, TaxAct’s huge library and expert tax help can guide you through the rest.

Their minion “bookmark” full-length lets you mark places on your return that you need to come when to later, so you’ll never forget a form.

Best For: People looking to transpiration providers for something with increasingly guidance.

| Self-employed | |

| Help Available | Live chat, email, and phone support; enormous blog library and supportive online community. |

| Form Limit | None |

| Final Cost | $79.95 federal $54.95 state |

3. Bonsai Tax

This one’s for the freelancers. Bonsai is defended to helping freelancers manage every part of their career, from contracts to invoicing and, that’s right, taxes.

While Bonsai is increasingly of a “tax prep” software, the weightier tax software won’t just file, it’ll help you with the hardest part – preparation.

Best For: Freelancers looking for help tracking their taxes, expenses, and clients throughout the year.

| Help Available | No live option, but large library of tax help. |

| Form Limit | N/A |

| Final Cost | $39 monthly |

4. eFile

eFile’s tagline is “It’s less taxing”, and it’s easy to see why.

As soon as you click onto their website, you’ll see dozens of resources designed to help you navigate your taxes.

eFile.com answers questions like “which forms will I need?”, “what are my deadlines again?”, and increasingly using helpful tools, sound bites, and videos.

If you’re someone who likes to know the ins and outs of their merchantry finances, this is the weightier tax software for you.

Best For: People who want to learn increasingly well-nigh filing taxes, and start filing on their own increasingly confidently.

| Self-employed | |

| Help Available | Real person support, but not in real-time. |

| Form Limit | None |

| Final Cost | $35 federal $28 state |

5. Taxfyle

Owners of mid-size small businesses simply don’t have the time or know-how to file taxes themselves.

As your merchantry grows, DIY becomes Don’t-IY.

That’s where Taxfyle comes in. With a lower forfeit than a unstipulated CPA firm and personalized help, Taxfyle is a life-saver.

Owners of small- to mid-sized businesses who need to have a professional do their taxes will find Taxfyle is the weightier tax software they could ask for.

Best For: People who don’t want to DIY their taxes.

| Self-employed | Small Business | |

| Help Available | A CPA or EA files your return. | A CPA or EA files your return. |

| Form Limit | None | None |

| Final Cost | $204.99 federal $39.99 state | $359.99 federal 49.99 state |

5. TurboTax

There really is a reason TurboTax is so popular.

Their user-friendly interface and prompt response times make them shine.

When it comes to finding the weightier tax software for your small business, they’re worth a look!

The self-ruling plan is helpful for individuals, and their small merchantry plans indulge you to file all the forms you need with no hassle and lots of help.

Best For: People who are filing taxes for their small business/freelance income for the first time.

| Self-employed | Self-employed Live | |

| Help Available | Live yack help, blog library, online community. | Live video help, screen sharing. |

| Form Limit | None | None |

| Final Cost | $119 federal $49 state | $199 federal $54 state |

6. H&R Block – Self-employed And Small Business

Savvy merchantry owners know that tax season comes once a year, but you need to be thinking well-nigh taxes all year-round.

That’s why H&R Block’s weightier tax software for self-employed and small businesses gives you wangle to tax experts no matter what time of year it is.

H&R Block’s tax representatives for this package go through specialized training to help small businesses.

They know all the ins and outs of federal and state tax prep, and you can plane segregate to have H&R Block do your bookkeeping and requite you a merchantry consultation.

Best For: People who want all their tax prep taken superintendency of year-round.

| DIY | File With A Tax Pro | |

| Help Available | Unlimited, on-demand yack help. | Virtual or in-person meetings, no DIY needed. |

| Form Limit | None | None |

| Final Cost | Starts at $100, varies by situation | Starts at $180, varies by situation |

7. Pilot

Speaking of year-round help, that’s what Pilot specializes in.

Pilot is the all-in-one financial solution for small and mid-sized businesses.

They take superintendency of bookkeeping, taxes, invoicing, and increasingly for your growing business.

Without a doubt, their wide suite of products makes them much increasingly than one of the weightier tax software options – they’re one of the weightier financial software options.

Their tax team can file your merchantry and personal taxes, giving you live updates withal the way.

Their tax plans are priced separately from their written services, meaning that you can start working with them on written surpassing deciding whether you want them to file taxes.

Best For: Fast-growing businesses who need tax and accounting help, and quick!

| Essentials | Standard | |

| Help Available | No DIY needed! You have a defended tax expert. | No DIY needed! You have a defended tax expert. |

| Form Limit | 10 1099-NEC included | 25 1099-NEC included |

| Final Cost | $1,950/year | Custom, whence at $4,950/year |

8. Avalara

When most people think of taxes, they think of filing tax returns.

The weightier tax software for small businesses moreover takes superintendency of your sales tax compliance. That’s where Avalara comes in.

Avalara can help you file taxes, but tax compliance is where they really shine.

Whether you’re a small business, a mid-size business, or somewhere in-between, Avalara helps you stay on top of tax laws.

They managed $19 billion in goods during the 2019 cyber week, and have helped users unzip increasingly than $18 billion in tax returns.

Best For: People looking for increasingly comprehensive tax software for their business.

| Returns For Small Business | |

| Help Available | 24/7 support and large video undertow library |

| Form Limit | None |

| Final Cost | $19 per month plus $25 per optional e-filing, with up to 60-day self-ruling trial |

10. Mazuma

Our very last pick for weightier tax software is a software that helps with your tax prep and filing.

Mazuma exists to help small businesses unzip the financial help that’s often out of their reach.

Large firms can often be out of budget, while smaller companies don’t offer one-on-one support.

Mazuma strives to be within your upkeep and offer live help with your small business’s written and taxes.

| Starter | Plus | |

| Help Available | Live help | Live help |

| Form Limit | None, but has less year-round tax help. | None, and will handle your merchantry and personal return. |

| Final Cost | $120/month | $180/month |

Related Blogs:

- 15 Smart Ways To Save Money From Income Tax

- How To Upkeep Your Tax Return?

Pain-Free Ways To File Taxes In 2024

We’ve said it surpassing and we’ll say it then – gathering information is the hardest part of filing your taxes.

This is just as true of picking a tax software as it is of anything else.

The good news is that by doing the research and picking the weightier tax software for your situation, you’re once washed-up with a big part of it!

Once you find a tax software that works for you, it’s a huge permafrost of work off your plate for next year.

Filing your taxes next year won’t be as nonflexible as this year.

The increasingly time you spend getting to know your money and your taxes, the less intimidating it’ll be.

Many of the weightier tax software companies have a newsletter you can subscribe to so you can alimony growing your knowledge.

Knowledge is power, expressly when it comes to something as elusive as taxes.

Just by doing this research, you’re miles superiority of the roughly 7 million people who don’t file taxes at all.

Filing a tax return can be an enormous uplift to your financial security.

Many people find that their tax return can help them pay lanugo debts, make important purchases, or perpetuate their savings account.

These things are all crucial to financial wellness, which makes filing your tax return using the weightier tax software a jumpstart on your financial journey.

The weightier tax software will help you file your taxes and unshut the door to so much more.

Here at Penny Calling Penny, our tax blogs are only a part of our growing library.

We’re defended to helping you learn to manage your money, no matter where you’re at on your financial journey.

Subscribe to our newsletter so you never miss a Penny, and we’ll see you next time!

FAQs

Filing taxes can finger overwhelming, but there are options to make it easier. You can use user-friendly tax software like TurboTax or H&R Block, rent a tax professional for personalized assistance, or trammels if you qualify for the IRS Self-ruling File.

Yes, TurboTax does offer a self-ruling version for simpler tax situations. However, alimony in mind that spare fees might wield for increasingly ramified scenarios. So review TurboTax’s options to see if the self-ruling version aligns with your tax-filing needs.

If you’re a tax preparer, finding the right software is crucial. Consider options like Intuit ProConnect Tax Online, Drake Tax, or TaxSlayer Pro, based on what suits your preferences and budget.

We know everyone’s situation is unique, so finding the weightier online tax filing service depends on your needs. TurboTax, H&R Block, TaxAct, and FreeTaxUSA are popular choices with user-friendly interfaces. Consider factors like cost, ease of use, and consumer support to discover the online service that genuinely fits your requirements.